Delta Neutral Option Strategy - How to Manage Greeks on Straddles

- Options Master Trader

- Nov 13, 2021

- 4 min read

Updated: Mar 15, 2024

When trading a delta neutral option strategy, traders must feel comfortable dealing with numbers and have a deep understanding of the Delta and the other Greeks.

This trading tutorial explains in depth how the five Greeks delta, gamma, theta, Vega and rho work in a complex strategy such as a straddle. By the end of this article, you should be able to understand how to manage the Greeks in order to trade a delta neutral strategy successfully.

The Greeks on a Delta Neutral Option Strategy

The Delta

In a neutral strategy such as a straddle, the delta should be as closer as possible to 0 when the position is open and until the expected event occurs. For this reason, you may consider making adjustments to your position if the delta is getting to much positive or negative while such event is approaching.

In a straddle, the overall delta depends on the deltas of both puts and calls you purchase. It works as follow:

Delta = 0 (neutral). You are buying ATM calls and puts. The calls you buy have +0.50 deltas, whilst the puts have -0.50 deltas resulting in a delta neutral position. This is the optimal and recommended status when you trade a straddle.

As time goes on and you are in your position, the stock price can either rise or fall in value. As a result, the overall delta can become gradually positive or negative as the stock price moves. Keep in mind that in a straddle the positive or negative deltas are merely an indication of direction, meaning that you make a profit as the stock rises or drops.

If the delta becomes positive (Delta > 0), it means that the underlying security is increasing in value. Call options from ATM become ITM increasing their delta somewhere from +0.50 to +1 depending on the intensity of the upward stock movement (e.g. +0.60); whilst put options from ATM become OTM decreasing their delta somewhere between -0.50 to 0 depending on the intensity of the upward stock movement (e.g. -0.40). The resulting overall delta is positive, meaning that your position is getting directional upward.

If the delta becomes negative (Delta < 0), it means that the underlying security is decreasing in value. Call options from ATM become OTM decreasing their delta somewhere from +0.50 to 0 depending on the intensity of the downward stock movement (e.g. +0.40); whilst put options from ATM become ITM increasing their delta somewhere from -0.50 to -1 depending on the intensity of the downward stock movement (e.g. -0.60). The resulting overall delta is negative, meaning that your position is getting directional downward.

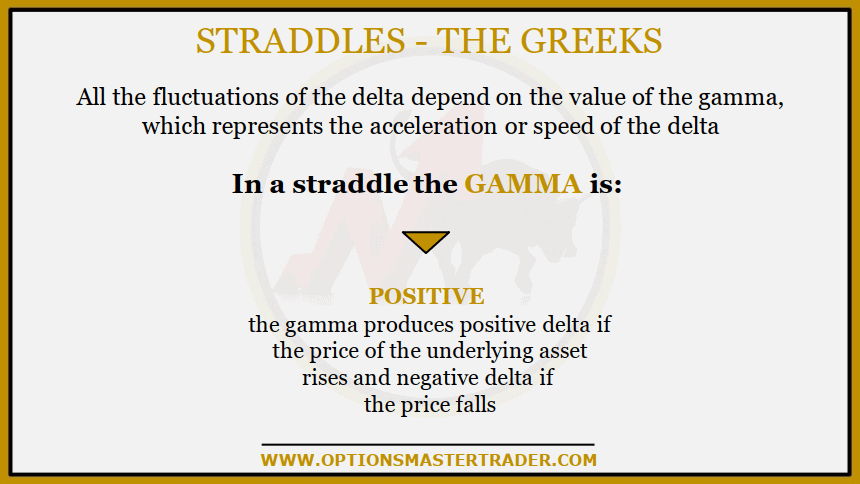

The Gamma

In a delta neutral strategy, gamma is always positive because you are buying options. This Greek reaches its greatest positive value within the two strike prices, where the influence on the delta is at its greatest. Conversely, as the stock price rises or falls, the gamma decreases its value having consequently a lower impact on the delta.

Furthermore, the closer to expiration you get, the higher is the level of risk involved if the position is still ATM or close. That is why gamma, as well as theta, becomes more significant as options approach expiration.

The Theta

As you buy call and put options (neutral position - net debit), theta is always negative. Time decay is against you and the negative impact on your position is greater when the stock price is between the two strike prices and as the expiration date come closer.

In fact, as theta is not a linear value, the less time an option has until expiration, the faster that option is going to lose its value. In a straddle this means that theta will increase dramatically its negative value when the position is unprofitable (ATM or close).

As a consequence, it can be very dangerous be stuck in a straddle after that the expected event occurred and, in any case, in the last month before expiration. It is strongly recommended to offset the position at least within a month before expiration.

Theta, as well as gamma, becomes more significant as options approach expiration.

The Vega

As the straddle is a neutral position and a net debt strategy (you buy option premium), Vega is always a positive value, meaning that an increase in implied volatility is helpful to your position. Such effect is much greater at the strike prices (ATM options) when the stock hasn’t moved yet.

Vega is greatest for options far from expiration and becomes less important while options approach expiration. As a result, the effect of implied volatility on a straddle can be substantial. For this reason, the straddle is also considered as a volatility strategy.

The Rho

In a straddle, rho can be either positive or negative depending on the direction in which the stock price is moving. Rho is positive when the stock rises, meaning that higher interest rates are helpful to your position (you make money when interest rates increase and lose money when they decrease).

Conversely, rho is negative when the stock falls, meaning that lower interest rates are helpful to your position (you make money when interest rates decrease and lose money when they increase).

The positive or negative impact of rho on a straddle decreases in value as options get closer to expiration.

What I just said may seem confusing to some, for this reason it is better to explain more in detail why rho can be either positive or negative for a straddle.

When interest rates rise, there is more convenience to keep money in your bank account then investing it on shares. However, when you choose to control the same amount of shares using a much lower amount of money through the purchase of call options, the remaining cash continues to earn interest in your bank account.

As a result, when interest rates rise, the purchase of call options becomes more attractive than the purchase of shares. Consequently, the increasing demand justifies a slightly higher price as measured by the options rho value.

In addition, when interest rates rise, there is more convenience to short shares to put extra cash in your bank account and take advantage of rising interest rates. The purchase of put options is an alternative to shorting shares which removes that benefit of having additional money in your bank account.

For this reason, when interest rates rise, the purchase of put options becomes less attractive than shorting the actual shares. Consequently, this slight drop in demand justifies a slightly lower price as measured by the options rho value.

_edited.jpg)

Comments